Upcoming Maintenance

Scheduled system maintenance will be at 12/28/2022 19:50 PST. The system will be unavailable for a few minutes at this time.

In my first article, I started to explain some of the reasons for WizerFood and features that are taking shape. In this article, I dive deeper into personal finance - an area that WizerFood has come to support, with ease. Why has it been easy? Because financial events happen, much like planned meals happen: they can be scheduled into the future and that creates interesting possibilities for analysis.

For example, I can add both income events (e.g. getting a pay check twice a month), and expense events (e.g. paying my rent or mortgage monthly on a set day of the month), and then I can look at my net income, not just today - but a month from now… or three… or six, and so on. By adding the ability to set a starting balance, we can track what a bank account balance might look like in the future. This can be quite useful. It tells us important things, like if we have extra capacity to put money aside for savings, or if we’re in need of some course correction.

As you might have guessed: I had a spreadsheet that I used in the past to give at least a high level view of where my finances might be in a few months. This was quite “rough” in my approach: I was rolling up a number of income and expense items together, and it was effective but not as accurate as I would like.

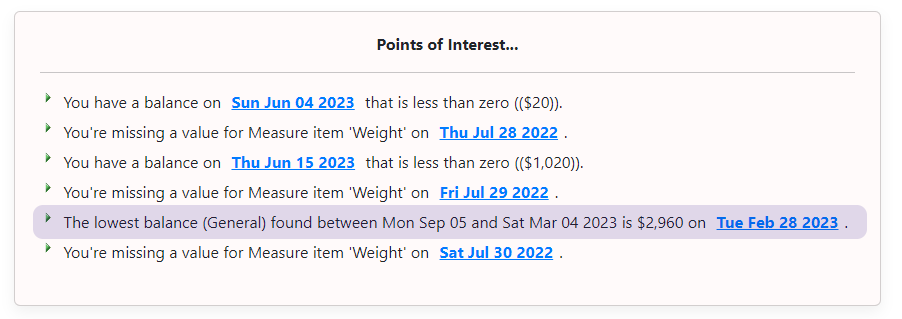

With WizerFood, I spent less than thirty minutes entering all my main recurring expenses and income in my calendar. I then set my current bank balance as a starting point, and I was happy to discover I track very, very accurately to future projected amounts. I thought that it’d be really nice to know my “lowest balance in the next six months” – so I added it as a Point of Interest, which is included on the Calendar view. If the lowest balance I see was say $800: then I could feel fairly comfortable if I transferred $500 somewhere else – pay down a loan, add to a savings account: whatever makes sense currently.

Events can be scheduled on intervals like “weekly” or even “bi-monthly, week-days” - among other interval types. I can also change a recurring amount as of a date – such as if I got a pay raise, or my rent goes up. These are just two examples of how you can capture your financial reality, inside WizerFood. We have more similar features coming and we rely on suggestions to build a truly community-focused product.

There are different ways to deal with how your money might flow between different bank accounts. For example, I have a checking account and a credit card account, where the checking account balance is most interesting to me on a tactical level. Why? I use it as a source to pay off the credit card account, so that transfer transaction is something I can track in WizerFood, as an expense. In a way, this helps force me to stay within a “discretionary spending limit” based on the fact I only allow myself a certain “pay-down” amount, per week, on the credit card. (The credit card covers most discretionary expenses, plus a few recurring ones that are fine lumping into the same bucket.)

If there are any exceptions to this (for example, a bigger, planned credit card purchase): that can be tracked as “supplemental pay-down” expense transactions – which only “works” if I can add them without putting my future checking balance “too low” for my liking. All of that can be alerted in WizerFood – and charted, which appeals to me, as a visual person.

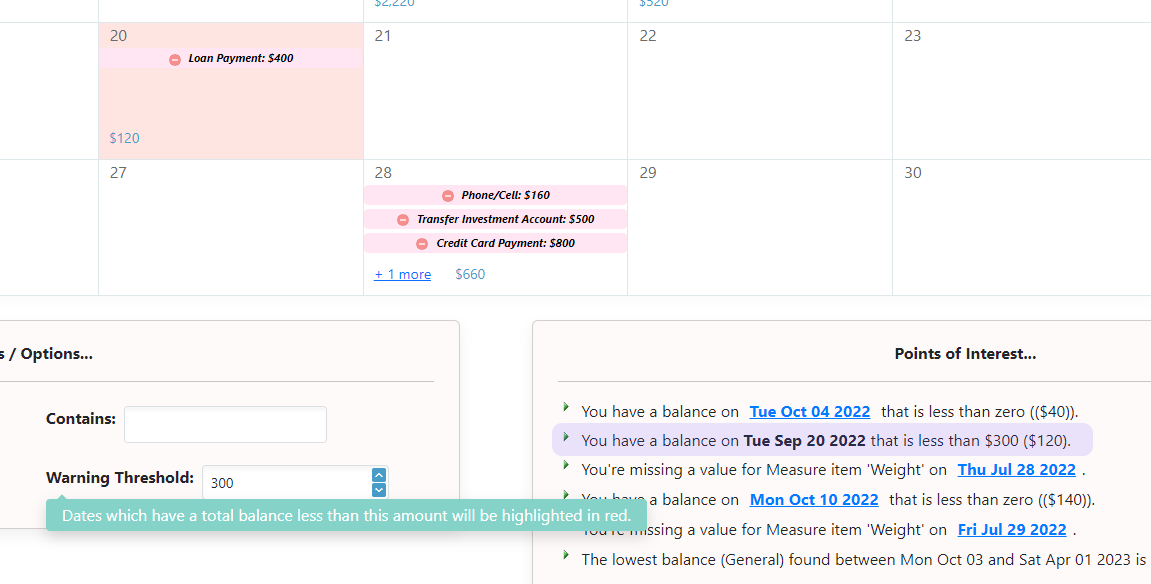

This approach doesn’t do some things like tell you how much you should be putting into a rainy day or investment account – but it can tell you what happens when you account for everything known - and some level of unknown, too. For example, if your goal is to keep a $2,000 “buffer” on your main bank account, then you can set the warning threshold value to “2000” on the “Filter / Options” panel, on your Calendar. This in turn causes days that fall below this level to be called out in the “Points of Interest” and highlighted on the Calendar itself:

This approach also won’t tell you that you’re spending too much on say a credit card account where you're not tracking every expense. Some people either won’t like this or perhaps need to have all actual expenses tracked. WizerFood may do this eventually, but it’s more suited to situations where you’re not into micromanagement. (I admit I'm not into that!) It works for me because my weekly recurring payment for my credit card creates my “box” that I have to work within. In effect, I treat it like a virtual debit card. (If you wanted to make this more concrete, you can even ask your bank to lower your credit limit to match your virtual limit.)

The overall approach to tracking finances allowed me to eliminate a spreadsheet, gain confidence in my budget – all with minimal effort. I spend very little time now tweaking my transactions, while feeling good about keeping a low but workable checking balance, so that any extra funds can go elsewhere, such as to savings or other appropriate places.

In my next article, I’ll pivot back to tips on managing your meal plans. Now more than ever in this challenging financial environment, food can be a large part of your budget, and finding ways to reduce food waste can improve both the environment – and your pocketbook!